Americans are working longer

Terry Arthur, 68, was a businessman earlier in his career, but he left the business world in 2001 to teach English full-time at Kaplan International Center.

Members of the Crenshaw community are hoping to restore the Leslie N. Shaw Park, and residents talk about their hopes for the park.

After over 20 years of serving the Crenshaw area, the popular hot dog joint, Earlez Grille, will be relocating due to the start of construction on the Crenshaw/LAX Expo line.

How the South Seas House transformed from a vandalized afterthought to a pristine community center in the West Adams District.

By Dan Li

Most Americans, especially baby boomers, expect to work past retirement age out of financial necessity and for health benefits. Also important to older employees are nonfinancial benefits such as enjoyment and staying physically and mentally active.

Terry Arthur, 68, was a businessman earlier in his career, but he left the business world in 2001 to teach English full-time at Kaplan International Center.

“Teaching English is kind of a passion for me, because I want students to have an easier time learning a language than I did,” said Arthur.

Besides teaching English, Arthur rows and goes to the California Yacht Club every weekend when he is not working.

“I’ve done this for more than 13 years,” Arthur explained. He also said teaching and rowing, two of the most important parts of his life, keep him energetic and refresh his mind. He hopes to continue teaching until he is 70 or 75.

Most seniors like to share their knowledge and experience with younger people. That’s why teaching is often one of the top job choices for highly educated and experienced seniors. Also, it’s better to work longer to save enough for retirement.

“Here in Los Angeles I work for two reasons: one, I enjoy what I do, and two, more importantly, it’s good when you’re living in Los Angeles to earn some money; this is an expensive place,” said Arthur.

It is projected that in 2030, American retirees will have at least $45 billion less in retirement income than they will need to cover basic expenses and care in a nursing home or from a home health care provider.

This sense of community and “win-win” is a key principle to those that work in the museum, seeing as they are a non-profit organization and work together with other nonprofits to help the Crenshaw community revive arts and culture.

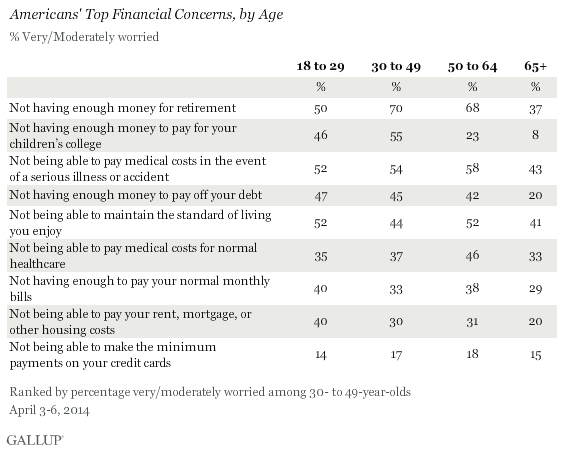

Personal financial concerns vary significantly across age groups. According to research from the American Association of Retired Persons, seven in 10 Americans ages 30 to 64 worry about not having enough money for retirement. A Gallup poll found that 59 percent of Americans are worried about not having enough money for retirement.

Social Security benefit payments are based on how much a person earned during his working career. Higher lifetime earnings result in higher benefits.

According to a Gallup poll, Americans now have a life expectancy of 79 years. Saving for the after-work years is considered a matter of national importance.

For most people, the days of a company-backed traditional pension that would provide for a comfortable retirement income are over. People now have to take more responsibility to save for their retirement.

“Usually most people need to replace 17 to 18 percent of their current income by retirement,” said Michael Loscavio, a financial planner and consultant at the University of Southern California Credit Union.

In his 2014 State of the Union address, President Barack Obama announced plans to create a new retirement savings account, “myRA,” aimed at helping millions of Americans start building a nest egg.

It remains to be seen whether this new type of savings plan, which will be available in late 2014, will ultimately alleviate Americans’ concerns about retirement.

How much money will be enough to retire? There is a “simple way” to find out, explained Loscavio, by “comparing your income with your spending.”

Loscavio was not surprised when he read that $1 million may not be enough for retirement. “Given today’s lifestyles and costs, it isn’t so much money for some people. It depends on the person, their lifestyle and what they are used to,” said Loscavio.

For some people, $1 million is definitely enough for retirement.

“Wow, that’s a huge amount of money to me. I never thought about that,” said Jason Wilson, 59, a construction worker.

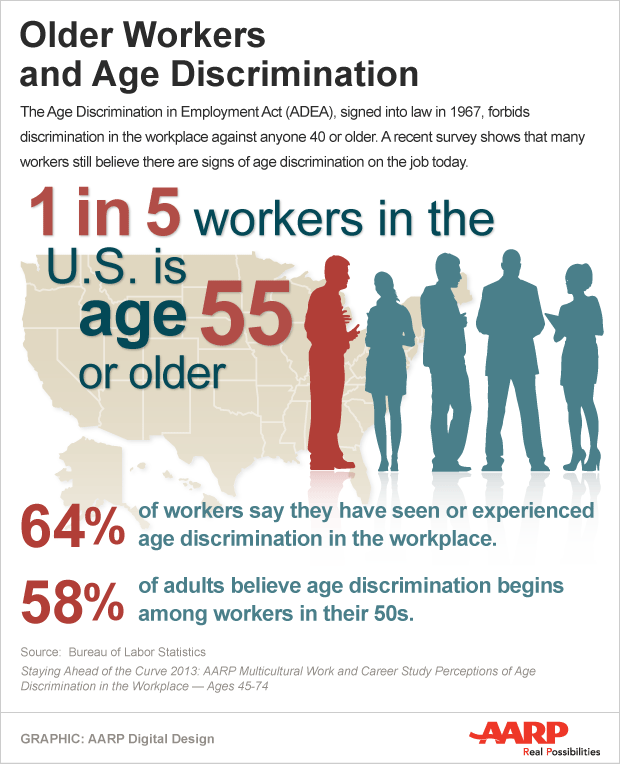

“The juxtaposition between the superior performance of older workers and the discrimination against them in the workplace just really makes no sense,” said Peter Cappelli, a management professor at the Wharton School of Business and member of the American Association of Retired Persons.

The era of social media being used mostly by younger people has passed. Now it is used by everyone, including the elderly.

“We encourage old people getting familiar with new technology, getting connected with people online, because that’s a new way of looking for jobs,” said Gillins.

According to a 2009 report from the Sloan Center on Aging and Work, hiring managers gave older employees high marks for loyalty, reliability and productivity.

Joseph Tilem, 86, is still working as a lawyer. He started receiving Social Security at the age of 65.

When asked when he plans to retire, Tilem said, “Never. I enjoy working. I want to work as long as I can.”

Toby Omens, 69, has been working as a children’s librarian at Beverly Hills Public Library for over 40 years.

“When I find wonderful books for kids, it’s always exciting. It never gets old,” said Omens.

“I’m happy to be able to help three generations of families. Many of the parents I helped when they brought their children, I’m now helping their grandchildren,” said Omens with a big smile.

These days, more and more retirees are continuing to work as a way to stay engaged, support a lifestyle or both. Many Baby Boomers have even discovered new and fulfilling careers that they are content to keep up with.